Journal Continues

Journal

At the OEC the trading journal is the key to everything. A trading journal is where strategies are adjusted, where a trader recognizes they are ready to trade live or that they should stop trading live.

Journals are useful for

Trade Development

Trades Taken

Improvement

Validation

Carry the Narrative

The image shows the math and the notes I made after the trade.. Notice that there was enough candles after the trade to see if the exit was a good choice

Journal Entries

When using a journal - a spreadsheet fails to really get the point across; trade entries and trade exits w/ profit and loss ... this is something that the broker offers you and there is no reason to write it again.

Pictures are a great way to journal a trade; take a picture of what your trade looks like and keep that as a source reference. Then take a picture of the trade you made & match it with the trade in your journal. See if they match.

This is one of 2 pictures taken (notes are on the other photo)

Journal Entries

When using pictures to journal, document the entry & the exit but also point out key warnings and signals within the chart you seen during the trade or after the trade.

Keep the picture and add it to your collection for that strategy. As time goes by you will develop statistical numbers for the trades and the strategies and will begin to identify "high conviction" plays versus the more "random walk" trades.

This also includes trade failures. If the trade was signaled as a failure, a picture can give traders the opportunity to look back and identfy these signals.

Journaling with Pictures

Taking a picture of the trade offers traders a chance to review additions to the trade. Pyramid Entires - adding to winners - is a difficult thing psychologically and as a mental exercise we want to evaluate where these "additional" contracts could have come into play.

Same with fading out of a trade that is not working; rather than taking a full stop at a single exit point a trader may consider exiting at various levels and giving price a chance to recover past a "wick point."

When you go back to annotate on the charts - consider where these "add in" spots would be and how you would approach using them.

An "RTH Open" trade within a trend day. One of 2 pictures that document a full day of trading the trend

Journaling with Pictures

Taking a picture of the trade gives traders a chance to look back 6 days, 6 weeks, even 6 months later and see their progress and achievements. It can be a valuable thing if a strategy begins to fail frequently - to identify what has changed between the current trades and the old trades.

Taking Pictures

Taking pictures of the trade gives traders a chance to slow down and look back on the market. We all have to learn what the trade is supposed to look like - and we have to learn how to read

warning signs

entry signals

exit signals

stop signals

ceilings

icebergs

liquidity zones

The greatest way to learn these signals is by reviewing the trades we took and examine the markets we were trading in. Document the trade - write up what you see and seek out assistance from the OEC for things you maybe do not see.

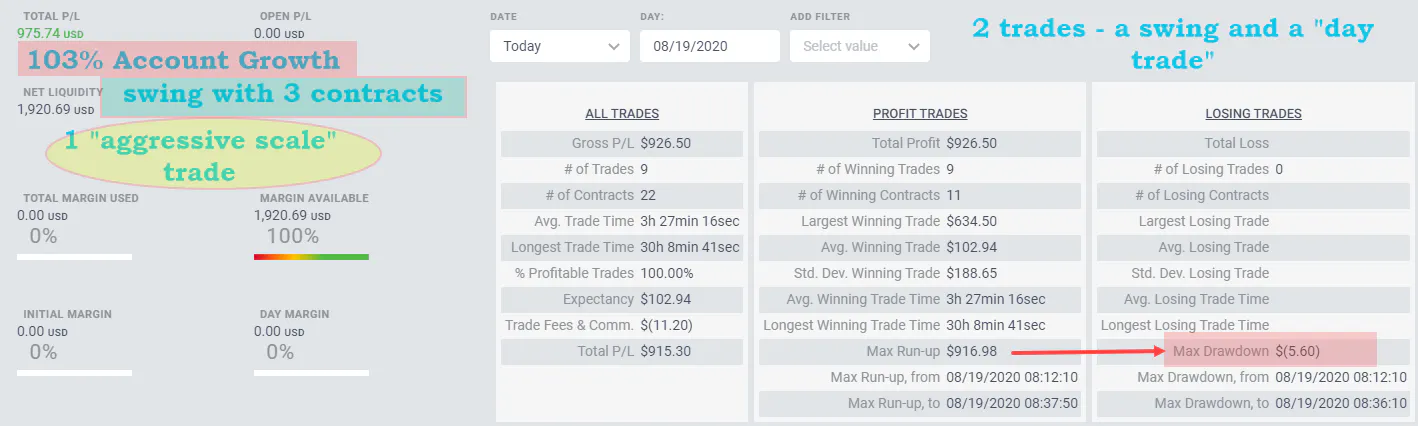

The profit is shown in the stats below. The notes here document my lack of commitment

Stats from the Trade Picture above this one

Aggressive Account Growth

Live Trade

In the picture below I was still in the trade but wanted to get a picture of the "trend trade" in action. Notice the notes added in the picture provides some insight into what I was doing and what my goals were.

Trend Trades are always hard to gage - since we never know when the trend will end or how quickly the MM's will flip price back the other direction.

Still in the trade - Journal while trade is active

This picture below is zoomed in a little too much but the notes provide clues that bring everything together. This was a "Busby" trade and the entry was taken from a "Quarter Bounce" or a "DBR" breakout. This is a dangerous trade if you are weak in money management but a great LRE for traders who use money management.

The 2 moving averages also provide clues - see how they are very spread out & have not "curled in" at all?

Busby off Support (the NASDAQ Quarter) and a DBR target in a TRB play

ADD IN Journal Work

Here in the picture below we can see that one trade was taken but due to a feature called "auto breakeven" the stops were moved up and the exit was triggered. So, I turned off that feature and took another trade - this time controlling the stop movement manually.

The chart notes show where I took off some of the trade as we entered resistance; the idea was to "get risk out" incase we failed to break through the resistance but to add back in if we made it past the resistance.

Unfortunately - I did not add back in & finished the trade with only a single.

Build your Journal

These pictures are from my own Journal work; hopefully they provide you with ideas about how to journal your own trades - but doing it exactly like I did … should NOT be your ultimate goal. Your goal - should be to take pictures of the things in your trade most important to the work you are doing.

Try to adjust the timeframe in the chart - or add more candles on the left side to see where your trade was (in relation to other price action). Consider taking more than one picture to really get a sense of the reason you took the trade in the first place.

In the picture above - the goal was a trade back to the pivot; this is often considered a risky trade as there are a lot of pivots over-head and we are "mid-range." This was also a "failed flag" setup and a wedge breakout. There was another trend line (not shown) that added conviction to the trade. Still, this is considered a "high risk" trade.

high RR trade

In the picture above - we have "Risk 1 to make 45" -

these "outsized moves" can really throw off the statistics. In this trade we had $3.50 of heat and made 158.00$ profit in 11 minutes. Big moves like this is what so many traders are trying to get but are unwilling to hold through a 20 point pullback to get it.

a week of trading the range

In the picture above we had a pretty boring week in the markets but was still looking at +400$ profit from trading micro-NASDAQ and netting an average 6 points while risking 2 points. (1:3 RR).

Carry the Narrative

There is another type of Journal worth keeping & that is a journal of the type of day you "think" we will get and a record of the actual trading day.

This is very powerful to day traders - as the Indexes generally will do the same thing it has done before and we need to recognize the signals which are repeating over & over again. This type of Journal Work is good for things like “how did the market react at the last 4 FOMC events?” or “How did the market react at the last Options Expiration date?”

By keeping a record or a Journal of the type of trading day we have - you have a record of your own anticipated market behaviors and the actual trading day with something useful for future trading days.